are political contributions tax deductible in oregon

Line 24 Political contribution credit. Here are the main reasons why.

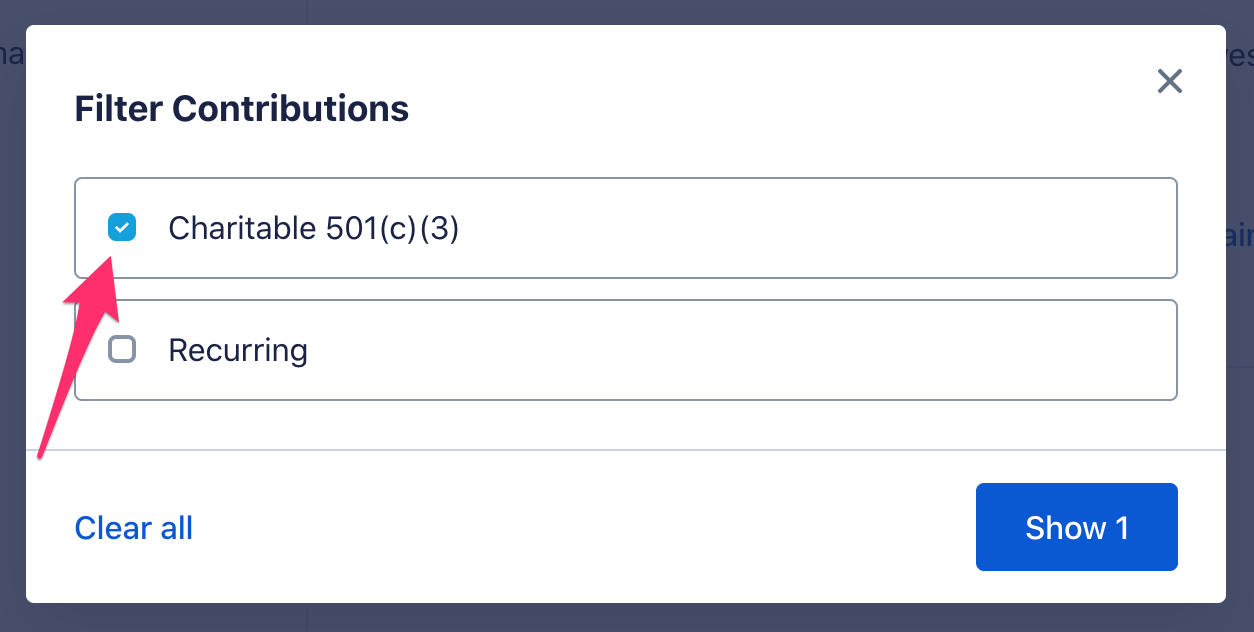

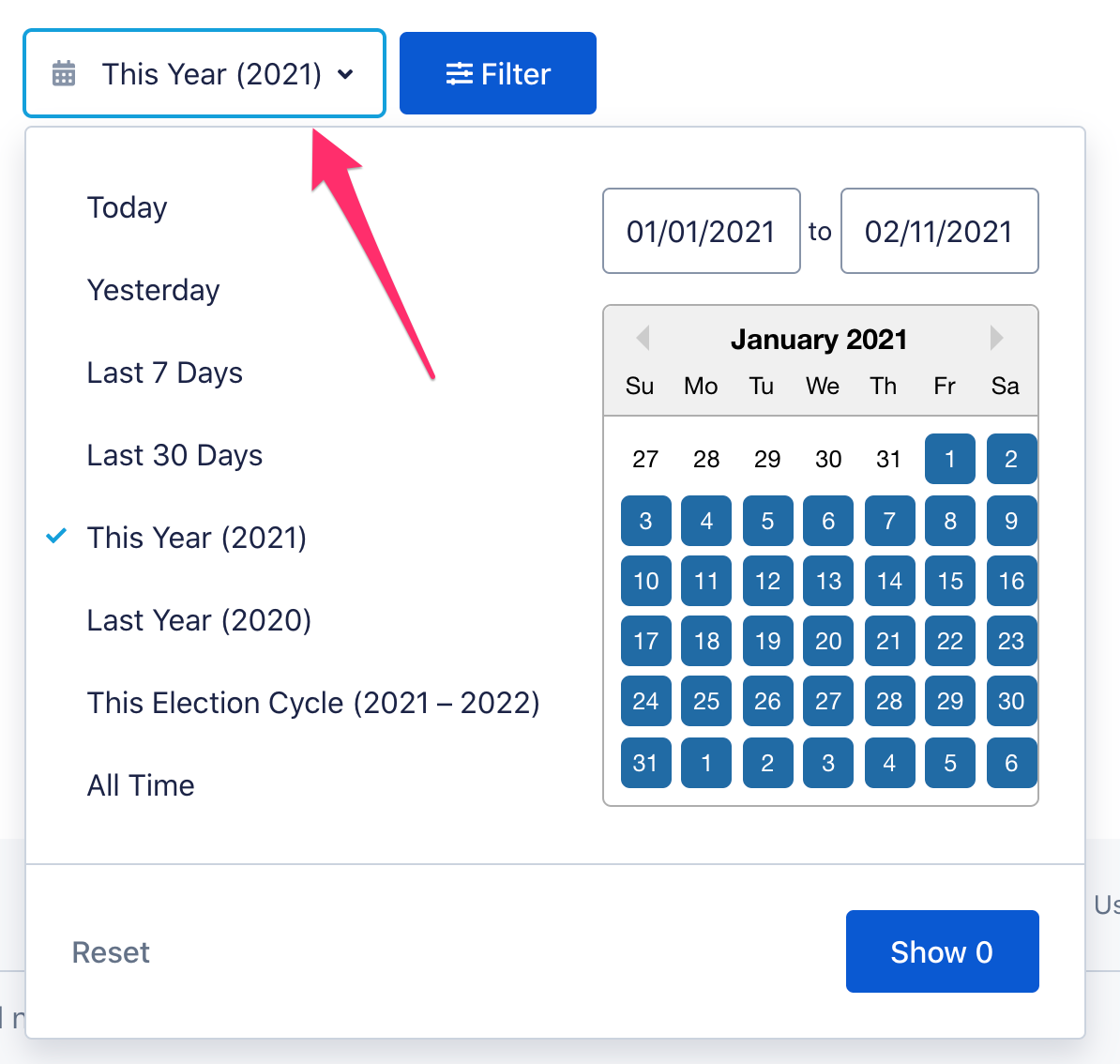

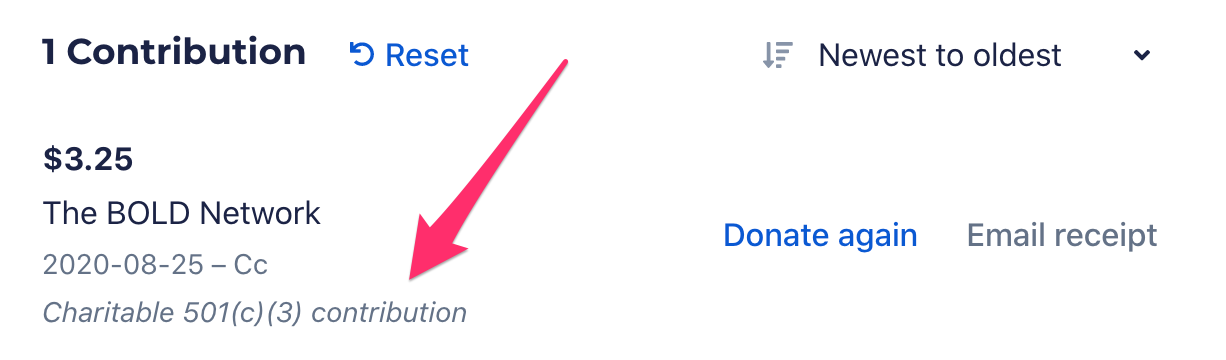

Are My Donations Tax Deductible Actblue Support

Qualified candidate for federal state or local elective office or the candidates campaign for an election in Oregon.

. This form itemizes your taxes to understand better what is or is not tax deductible. Ad File For Free With TurboTax Free Edition. A declaration of candidacy in November 2011 and appeared on the ballot for the 2012 primary election as a candidate for Oregon state senator.

Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. Use e-Signature Secure Your Files.

Credit for Political Contributions 1 In General. Upload Modify or Create Forms. To qualify for the political contribution credit the contribution must be a voluntary contribution of money made to one of the following.

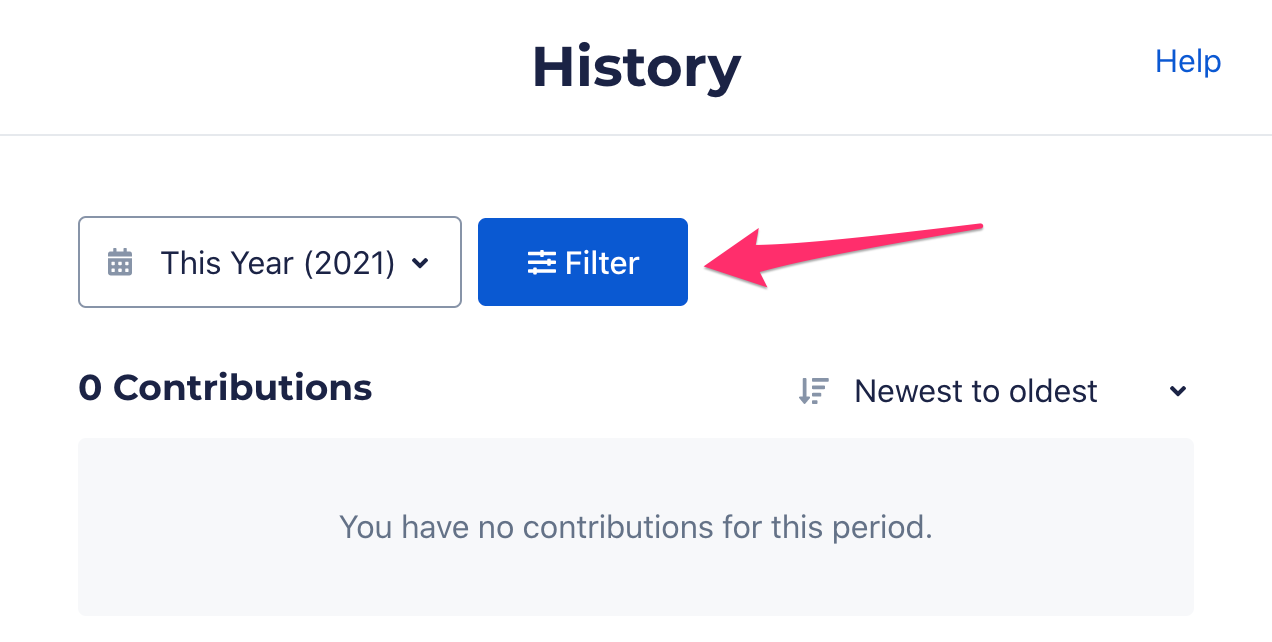

Ad IRS 1120-POL More Fillable Forms Register and Subscribe Now. You may claim a standard credit of up to 50 100 if youre filing a joint return for cash contributions you made during 2021 to any. This screen will be seen after the Adjustments Summary screen.

These taxes should be documented and kept for future reference. Get Your Maximum Tax Refund. Charitable contributions claimed as Oregon tax payments.

Political donations are not tax-deductible but contributions to churches mosques temples or other religious groups are taxed. Artists charitable contribution reported on the nonresident return form 600. Political contributions deductible status is a myth.

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. See If You Qualify and File Today.

It is not deductible for Federal. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. When you are in the State Taxes section for Oregon there is a screen titled Political Contribution Credit where you are able to enter the amount of your Oregon political contributions you are referring to.

Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. Note that there is a difference between the two. Federal income tax refunds.

Part-year and nonresident filers report these deductions and modifications on Schedule OR-ASC-NP. Individuals can donate up to 2900 to a candidate committee per election up to 5000 per year to a PAC and up to 10000 per year to a local or district party committee. June 4 2019 654 PM.

Try it for Free Now. Federal income tax paid for a prior year. Montana offers a tax deduction.

Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. You can only claim deductions for contributions made to qualifying organizations.

Shell report 16000 28000 12000 on Schedule OR-A line 5. You are to itemize your taxes on form 1040 Schedule A. Oregon deduction for taxes paid to Maine by 12000.

Political Campaigns Are Not Registered Charities. A tax deduction allows a person to reduce their income as a result of certain expenses. You cant deduct a charitable contribution for which you received an Oregon tax credit as a payment of Oregon.

The amendments to ORS 316102 Credit for political contributions by section 49 of this 2019 Act apply to tax years beginning on or after January 1 2020 and before January 1 2026. There are five types of deductions for individuals work. As of 2020 four states have provisions for dealing with political contributions.

Arkansas Ohio and Oregon offer tax credits. All four states have rules and limitations around the tax break. ModificationsSchedule OR-ASC-NP section D Code.

Ad Deductions for Healthcare Mortgage Interest Charitable Contributions Taxes More. Political contributions arent tax deductible.

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Political Contributions Tax Deductible H R Block

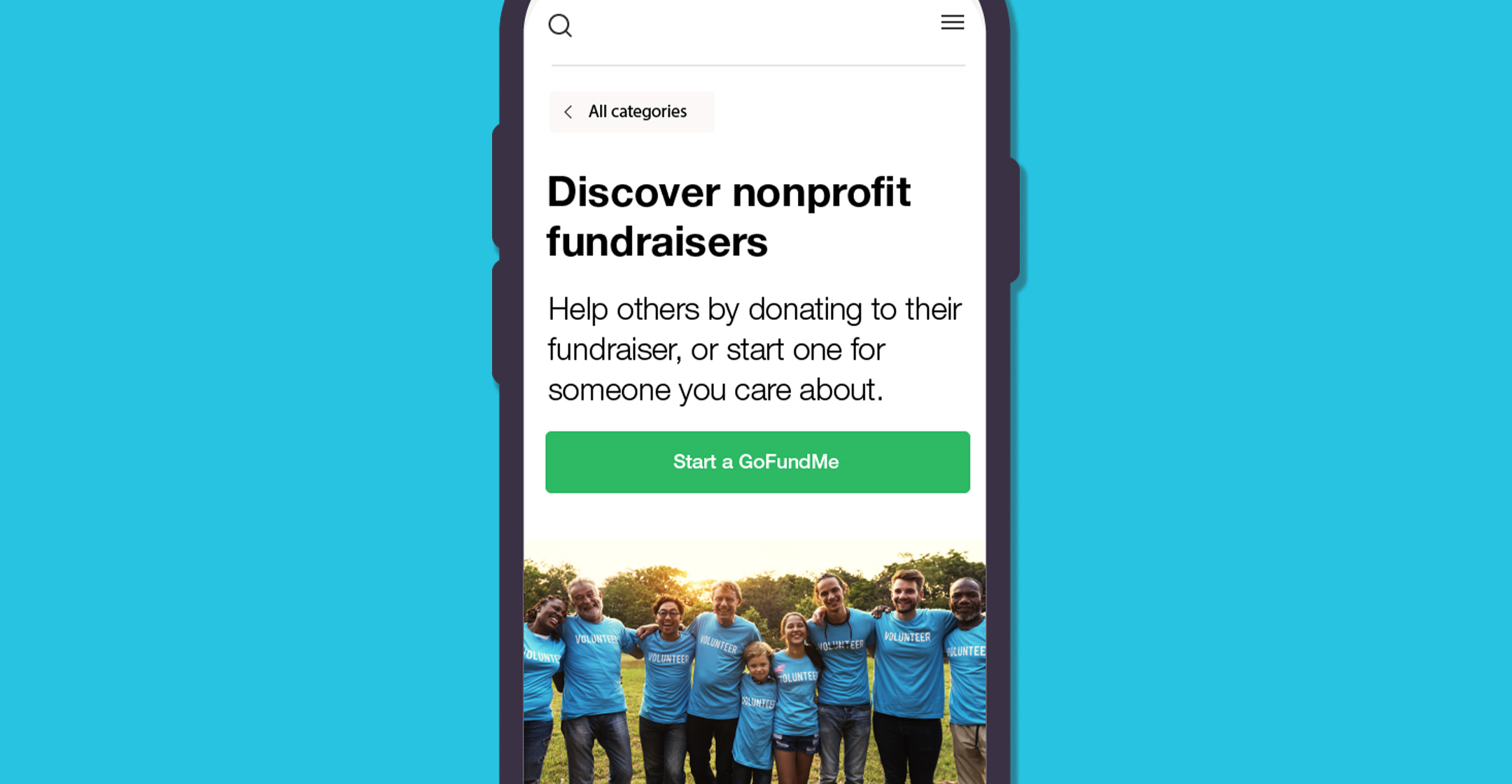

Are Gofundme Donations Tax Deductible We Explain

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible Smartasset

Free Political Campaign Donation Receipt Word Pdf Eforms

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Why Political Contributions Are Not Tax Deductible

Why Political Contributions Are Not Tax Deductible

Why Is A Tax Deduction Allowed On Amounts Donated To A Political Party In India Quora

Are Political Contributions Tax Deductible H R Block

Are Political Donations Tax Deductible Credit Karma

Are My Donations Tax Deductible Actblue Support

Corporate Political Donations Voter Suppression And Gun Control Top Political Cartoons

Why Political Contributions Are Not Tax Deductible

States With Tax Credits For Political Campaign Contributions Money